The Advantages and disadvantages of Offshore Investment for Long-Term Financial Safety

The Advantages and disadvantages of Offshore Investment for Long-Term Financial Safety

Blog Article

Understanding the Sorts Of Offshore Investment and Their Unique Features

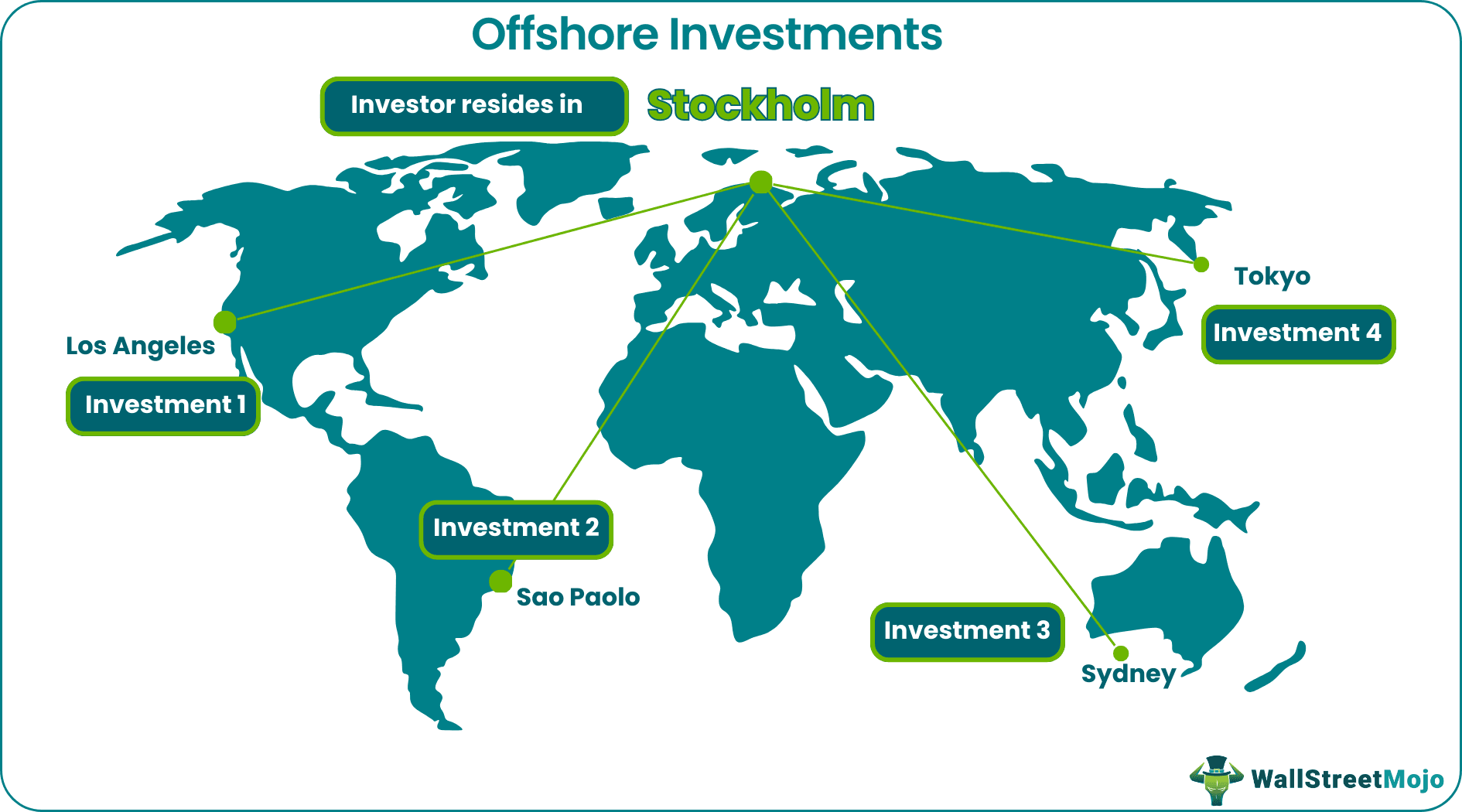

In an increasingly globalized economic situation, recognizing the various kinds of offshore financial investments is essential for effective riches management and property protection. Each investment car, from overseas financial institution accounts to shared funds and depends on, provides distinctive features tailored to meet varied financial goals.

Offshore Financial Institution Accounts

Offshore financial institution accounts offer as a tactical monetary device for companies and people seeking to diversify their properties and take care of money threat. These accounts are usually established in territories that use desirable financial policies, personal privacy defenses, and a stable political and economic atmosphere. By holding funds in varied money, account holders can effectively alleviate the threats related to currency changes, guaranteeing higher economic security.

However, it is important to adhere to all relevant tax regulations and guidelines when using overseas banking services. Failing to do so may result in legal consequences and punitive damages. As a result, potential account owners should look for specialist recommendations to browse the intricacies of offshore financial and guarantee they are fully certified while reaping the advantages of asset diversity and danger monitoring.

Offshore Mutual Funds

Buying common funds can be an effective approach for individuals looking for to gain access to international markets while taking advantage of expert administration and diversity. Offshore common funds serve as a compelling option for financiers seeking to maximize chances past their residential markets. These funds pool funding from several capitalists to purchase a varied profile of assets, which may consist of equities, bonds, and different investments.

One of the main advantages of overseas mutual funds is the potential for improved returns with accessibility to worldwide markets that may not be readily available locally. These funds usually offer tax advantages depending on the jurisdiction, allowing capitalists to maximize their tax obligation responsibilities. In addition, specialist fund supervisors proactively take care of these financial investments, making educated choices based upon extensive study and market evaluation.

Financiers in offshore shared funds benefit from the versatility to select different fund techniques, ranging from conservative to hostile financial investment approaches. This range allows individuals to align their financial investment selections with their threat tolerance and financial goals. Nevertheless, it is important for investors to perform complete due persistance and recognize the regulative environment, costs, and dangers connected with these financial investment lorries before devoting capital.

Offshore Depends On

Trusts stand for a critical monetary device for individuals seeking to take care of and safeguard their properties while potentially gaining from tax obligation effectiveness. Offshore Investment. Offshore trust funds are established outside the person's home country, enabling for enhanced possession defense, estate planning, and privacy advantages. They can safeguard assets from financial institutions, lawful cases, and divorce settlements, making them an enticing option for well-off people or those in risky professions

Additionally, offshore depends on can provide substantial tax obligation advantages. It is crucial to browse the lawful complexities and compliance needs associated with overseas trusts, as stopping working to do so can result in severe fines.

Offshore Realty

An expanding variety of investors are transforming to property in foreign markets as a way of diversifying their profiles and profiting from worldwide chances - Offshore Investment. Offshore property financial investments offer a number of benefits, including potential tax obligation advantages, possession defense, and the opportunity to acquire buildings in emerging markets with high growth capacity

Buying overseas property permits individuals to benefit from desirable residential or commercial property regulations and laws in certain jurisdictions. Lots of countries provide rewards for international capitalists, such as decreased her response taxes on resources gains or revenue created from rental residential or commercial properties. In addition, having realty in an international nation can function as a bush against money variations, giving security in unstable financial climates.

Furthermore, offshore realty can develop paths for residency or citizenship in specific territories, improving monetary and personal flexibility. Investors usually look for buildings in prime areas such as metropolitan facilities, playground, or areas undertaking considerable development, which can yield eye-catching rental returns and long-term admiration.

However, potential capitalists need to conduct complete due diligence, understanding neighborhood market conditions, lawful frameworks, and residential property management ramifications to optimize their offshore property investments successfully.

Offshore Insurance Products

Checking out overseas insurance policy products has actually become an increasingly prominent approach for businesses and people seeking enhanced monetary security and property defense. These items supply unique benefits, including tax benefits, personal privacy, and adaptable financial investment choices customized to business or personal requirements.

Another notable group includes health and traveling insurance coverage, which may supply detailed coverage and securities not offered in the insurance holder's home country. These items can be especially useful for expatriates or frequent vacationers who encounter distinct threats.

Eventually, offshore insurance products offer a compelling option for those looking to bolster their monetary strategies. By supplying tailored solutions that highlight privacy and tax performance, they can play a critical role in a varied investment portfolio.

Verdict

Finally, offshore financial investments present varied possibilities for wealth administration and useful site property protection. Each kind, including offshore checking account, common funds, depends on, realty, and insurance coverage items, offers distinct advantages customized to details financial goals. Using these financial investment lorries can enhance portfolio diversification, enhance tax obligations, and give financial protection. Recognizing the distinct features of each offshore investment is vital for people and entities looking for to browse the complexities of global finance efficiently.

In a progressively globalized economy, recognizing the various kinds of offshore investments is essential for effective wealth monitoring and possession security. Each financial investment vehicle, from overseas financial institution accounts to shared funds and depends on, provides unique functions tailored to fulfill diverse financial objectives.In addition, offshore bank accounts can offer access to a range of economic services, consisting of financial investment possibilities, lending centers, and wealth monitoring options.Investors in overseas mutual funds profit from the versatility to pick various fund techniques, ranging from traditional to aggressive financial investment techniques. Comprehending the special features of each overseas investment is essential for people and entities looking for have a peek at these guys to navigate the intricacies of global money properly.

Report this page